:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

You can find companies with similar selling, general & admin expenses using this.

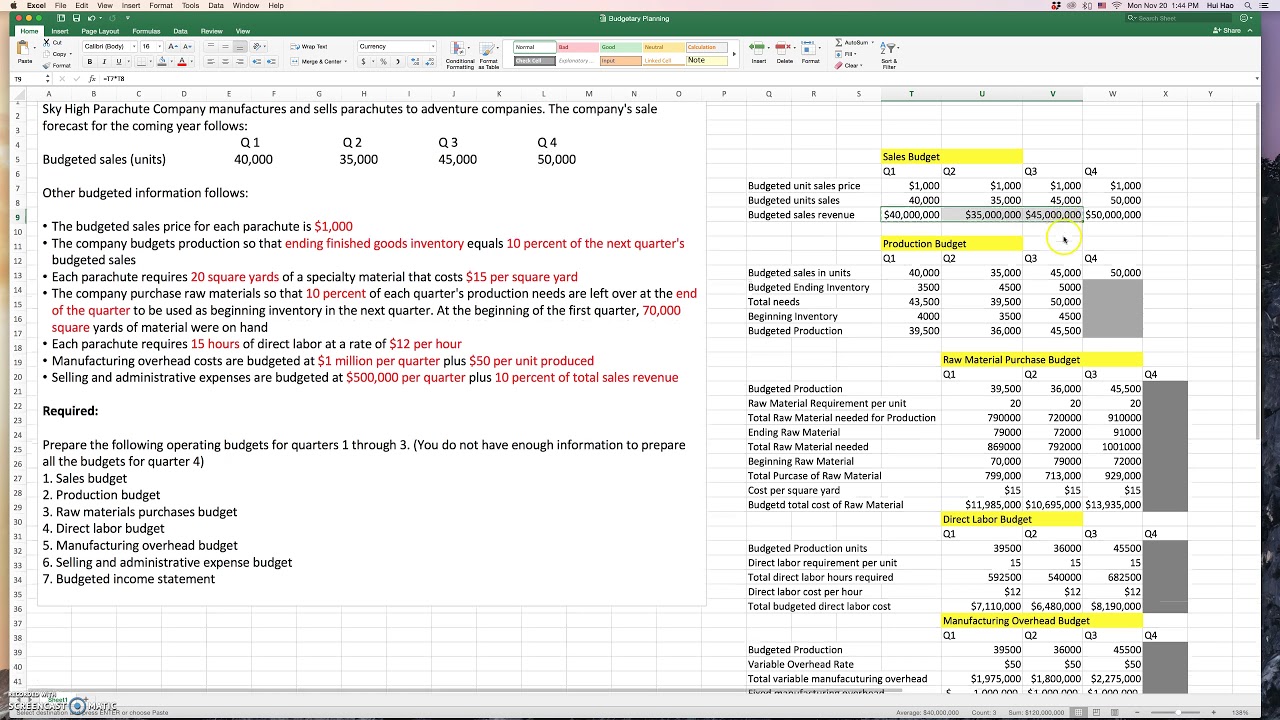

In spite of their geographic co-location, their roles are substantially different and consolidating their data into a single response would make it less meaningful. The other group does general ledger accounting for one of the three business units. One performs general ledger accounting for the corporate headquarters, which has three business units. D) The first line of an income statement lists the revenues from the sales of. C) The last or bottom line of the income statement shows a firms net income.

B) The income statement shows the flow of revenues and expenses generated by a firm between two dates. A general ledger accounting unit located in Germany has two groups. A) The income statement shows the cash flows and expenses at a given point in time.Is data meaningful at a consolidated level?.Do they share any performance measures?.Do they support the same region or product group?.Do they serve many of the same customers?.When trying to determine if related parts of your operation should be considered a single business entity, look for the following characteristics: Within your organization, diverse departments may be geographically co-located, with closely integrated operations that form part of one "business entity" which may be a great distance apart. is part of a cost or revenue center within the company.

performs significant aspects of the processes for the surveys identified, or.Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2019.For survey purposes, a business entity is defined as an entity that: Garcon Company Pepper Company Beginning finished goods inventory $14,700 $19,450 Beginning work in process inventory 17,900 19,950 Beginning raw materials inventory (direct materials) 7,100 12,300 Rental cost on factory equipment 32,500 25,000 Direct labor 20,200 37,800 Ending finished goods inventory 19,250 14,800 Ending work in process inventory 24,100 21,400 Ending raw materials inventory 6,400 8,000 Factory utilities 12,900 12,750 Factory supplies used (indirect materials) 10,900 4,300 General and administrative expenses 26,500 46,000 Indirect labor 2,300 8,800 Repairs-Factory equipment 7,460 2,000 Raw materials purchases 43,000 68,500 Selling expenses 60,800 46,000 Sales 231,030 302,510 Cash 31,000 20,200 Factory equipment, net 227,500 166,825 Accounts receivable, net 16,200 24,700 Required: 1. PepsiCo sg&a expenses for the twelve months ending Jwere 36.263B, a 12.76 increase year-over-year. PepsiCo sg&a expenses for the quarter ending Jwere 8.542B, a 15.64 increase year-over-year. The following data is provided for Garcon Company and Pepper Company. Sg&a expenses can be defined as the sum of all selling, general and administrative expenses.

0 kommentar(er)

0 kommentar(er)